The Conservation Economics Institute (CEI) recently released a report titled, Economic Effects of Pausing Oil and Gas Leasing on Federal Lands. The report uses economic research to examine the effects of the Biden administration’s executive order pausing new federal land leasing pending a comprehensive review of leasing and permitting policies. It concludes that national economic impacts will be “negligible” and regional impacts, including in Utah, will be “minimal in the short term.”

Among its many findings, the CEI report determined that:

- National economic impacts will be negligible since federal onshore oil and gas production constitutes a minor component of total domestic production—6% and 8%, respectively.

- There is no correlation between federally leased acres and oil and gas employment.

- There are greater than 14 million acres of undeveloped leases on federal lands, or more than 50% of all onshore leased federal land. Assuming productivity similar to producing federal leases and accounting for lease expirations, existing leases can theoretically support 75 years of future drilling opportunities on all U.S. federal lands.

- Regional economic impacts will be minimal in the short term because oil and gas operators have stockpiled thousands of leases and drilling permits.

- The benefits of a federal leasing pause outweigh the costs by at least a ratio of 40:1.

- Utah has 63 years of drilling opportunity on existing leases under a medium-intensity scenario, and 98 years under a low-intensity scenario.

As discussed below, the CEI report’s finding that a temporary leasing pause—even if in place for years—will have little, if any, impact in Utah is also corroborated by data and studies prepared by the state of Utah and Bureau of Land Management (BLM).

First, the temporary federal leasing pause—which does not impact development of existing federal leases—will have little, if any, short-term impact on oil and gas production in Utah.

In 2021, the Utah Governor’s Office of Energy Development (OED) prepared a fact sheet on the potential impacts of the Biden administration’s leasing pause. The document concluded that any potential impacts would be, at most, minimal. Among its findings, the OED determined that:

- Only 23 percent of the oil, and 53 percent of natural gas, produced in Utah comes from federal lands, respectively.

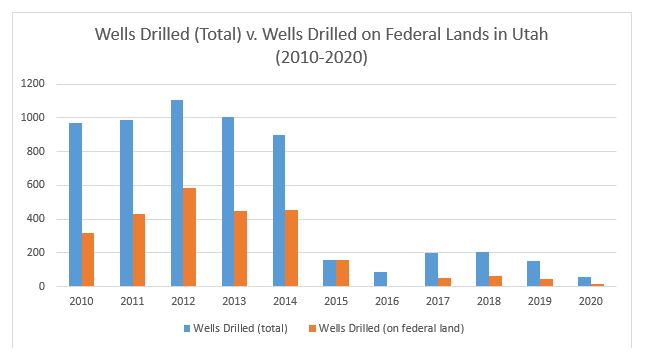

- From 2015-2019 only 17 percent of all new oil wells drilled in Utah were drilled on federal lands and that this trend is anticipated to continue in the future “with no anticipated increase in drilling on federal lands.”

- “With continued low [natural gas] prices, there will be limited drilling for [natural gas] regardless of federal drilling restrictions.”

TAKEAWAY: The majority of oil and gas development in Utah occurs on state and private land and thus a federal leasing pause will have minimal, if any impact on the oil and gas industry.

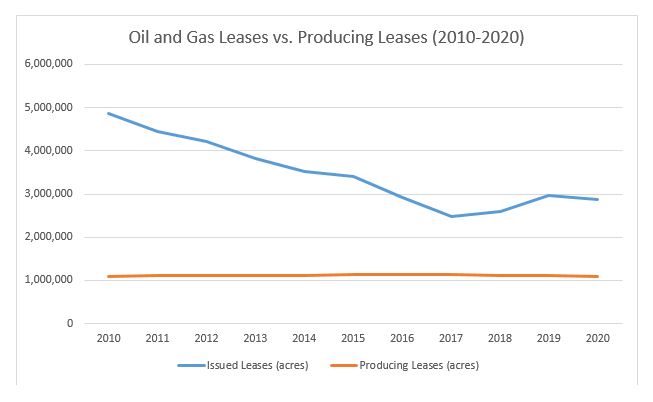

Second, in Utah, operators have stockpiled nearly two million acres of unused and undeveloped oil and gas leases.

- According to BLM’s most recent data, there are 2,880,985 acres of federal public lands in Utah currently leased for oil and gas development. However, only 37 percent of the leased acreage has been developed—that is, industry has hoarded more than 1.7 million acres of undeveloped leases in Utah.1

- As a result of the large stockpile of unused leases, OED concluded that even if the leasing pause were to last 8 years “Utah has more than enough potential well locations that could be drilled without major disruption to overall activities.” In fact, the CEI report concluded that based on the slow pace of development and large stockpile of unused leases, operators in Utah have more than 60 years of future drilling opportunities on existing leases.

TAKEAWAY: Industry has years of future drilling potential based on current stockpiled non-producing leases and any leasing pause will not have an immediate impact in Utah.

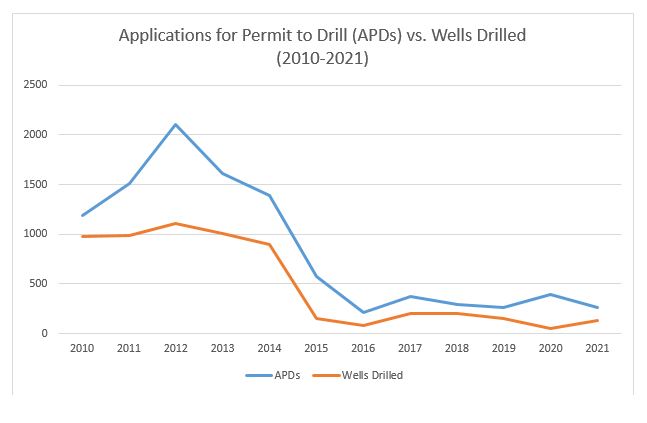

Third, in Utah, oil and gas operators have also stockpiled approved—but not drilled—applications for permit to drill (APD).

- According to data maintained by the BLM2 and Utah Division of Oil, Gas and Mining3, less than half of all approved APDs in Utah are eventually drilled and of those drilled less than half (44 percent) are on federal lands.

- In a recent report, the United States Government Accountability Office concluded that nationwide oil and gas operators are sitting on almost 10,000 unused approved drilling permits.

- As a result of industry’s stockpiling of approved APDs, the OED report concluded that in Utah “the current list of [approved and submitted] APDs would last over 8 years.”

TAKEAWAY: Industry has stockpiled thousands of unused drilling permits and drills less than half of the permits that are approved (less than half of which are on federal land).

Finally, the only short-term effect of a federal leasing pause will be lost lease revenue, which is very minimal in Utah.

- In 2020, BLM issued only 17 leases in Utah, covering 11,045 acres. In total, the high bidders paid just $51,617 to acquire these leases.

- The demand for new oil and gas leasing in Utah is so low that the Utah School and Institutional Trust Lands Administration (SITLA) has cancelled several past auctions. SITLA leasing is not affected by a federal leasing pause.

TAKEAWAY: The oil and gas industry has little interest in leasing and development in Utah.

1 Available at https://www.blm.gov/programs-energy-and-minerals-oil-and-gas-oil-and-gas-statistics (follow hyperlinks for “Table 2 Acreage in Effect” and “Table 6 Acreage of Producing Leases”).

2 Available at https://www.blm.gov/programs-energy-and-minerals-oil-and-gas-oil-and-gas-statistics (follow hyperlink for “Table 8 Wells Spud”).

3 Available at https://oilgas.ogm.utah.gov/oilgasweb/statistics/spuds-by-year.xhtml.