Thank you, as always, for supporting the Southern Utah Wilderness Alliance. You may be aware that Congress passed the Coronavirus Aid, Relief, and Economic Security (CARES) Act on March 27, 2020. Included in this legislation were several provisions that may change your charitable donations this year. Please consider the following:

You can now deduct your gift to SUWA, even if you take the standard deduction.

The CARES Act allows for up to $300 in an above-the-line deduction for charitable gifts made in 2020 and claimed on taxes in 2021. This means that you can lower your income tax bill by giving to SUWA today, even if you take the standard deduction on your taxes. Please talk with your accountant to learn more.

If you itemize deductions, there are new charitable deduction limits. The CARES Act increases the existing cap on charitable cash contributions for those who itemize, raising it from 60% of adjusted gross income to 100% in 2020. Please talk with your accountant to learn more.

Were you planning to take a required minimum distribution (RMD) from your retirement account in 2020? The CARES Act waives all RMDs for individuals over the age of 70 ½ who own specified retirement accounts in 2020. However, for account owners who began taking their RMDs prior to 2020, you can still choose to send a qualified charitable distribution to SUWA and potentially decrease your tax burden. For more information, please talk with your retirement account administrator or accountant.

SUWA lacks the expertise to offer tax advice, so please consult a tax professional to determine what options work best for your unique situation.

Lastly, there are two particularly helpful ways to support SUWA during this time:

Signing up for monthly giving ensures that the fight to protect wild Utah continues through these challenging times. Monthly giving of any amount is easy and secure; includes all the benefits of membership; and provides SUWA with reliable, year-round funding. To sign up, or for more details, please visit our Monthly Giving page.

Please consider including SUWA in your estate plans in order to leave a lasting legacy for America’s redrock wilderness. Such plans may also provide tax savings for you or your loved ones. For more information on planned giving, please visit our Planned Giving page, or talk with your financial advisor or attorney. If you have already included SUWA in your estate plans, please let us know by contacting Michelle Martineau, our administrative director, at michelle@suwa.org or by phone at (801) 486-3763.

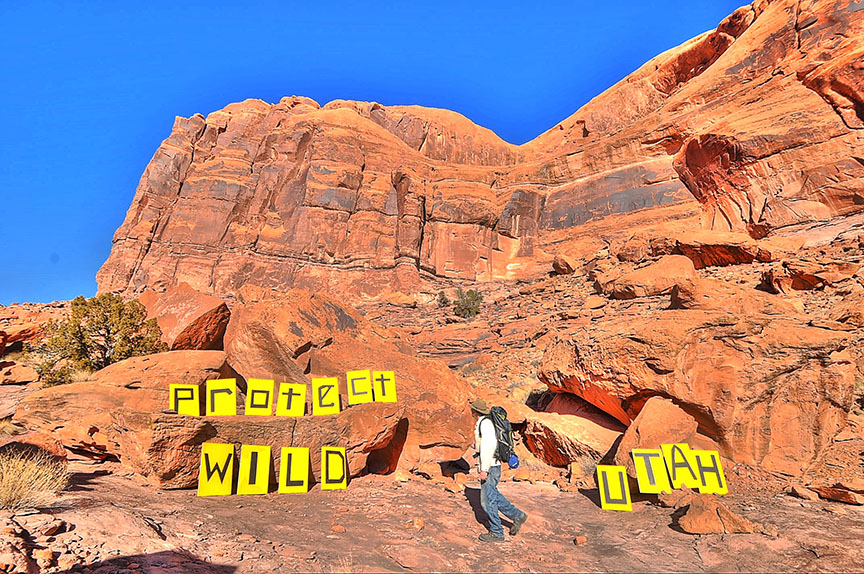

If you have any questions, please contact us at membership@suwa.org or (801) 486-3161. Thank you for being part of the movement to protect wild Utah!

Southern Utah Wilderness Alliance Tax ID: 94-2936961

Southern Utah Wilderness Alliance Mailing Address: 425 East 100 South, Salt Lake City, UT 84111